To answer that question we have to get back to ancient times. At the beginning there was no such word like money. People were trading their goods produced by their own hands. This is called barter – a situation where two (or more) transaction traders are exchanging a commodity for a commodity. That was a good option, but had one disadvantage – human nature. Everybody wants to build their own wealth, and here comes the question. How is that possible by just trading a commodity for a commodity? You can’t. To build wealth you need something that stores a value over time, value that would be recognizable through people you surround, or even better – throughout the world.

But why didn’t people pay for everything in e.g. salt, or in cereal? It is widespreaded everywhere, salt can be stored for years, cannot rot, everybody uses it.

Here comes the answer. Because it is common. There are various ways of obtaining it, and almost everybody can produce it. So people needed a thing which is uncommon, is hard to achieve, is limited by supply, durable, divisible, inert for human’s body, in long term is being a store of value, and the most important thing – is recognizable everywhere.

After proper research, people decided to as a payment method use metals – elements which almost all requirements described above are fulfilled. But there is only one winner, which has won above all – gold. Gold comparing to other metals, isn’t harmful for human’s body, it is durable to atmospheric conditions, can only be dissolved by aqua regia – a combination of concentrated chloric acid with nitric acid – (I suppose very few people has access to it), and there is a limited supply on Earth which has to be received by humans hard work. But after thousands years, we have come to banknotes – we’re not using physical form of gold. How did that happen? Imagine you are at the marketplace, wanting to pay for commodity – nothing hard right? Please, have a very close look at the banknote below.

Not really. You’re overweight by gold’s weight. You had to hold your gold still on you, and that might be burdensome, and even dangerous. And here it came – a brilliant idea – banks have been created – places, where you could store your gold, in exchange the banks were giving you a note testifying how much gold you have, in bank’s storage – a bank – note. If you wanted to buy something – easy peasy – you gave a note that given amount of gold from your lock is now buyer’s property, and that was it. While time was elapsing, more people were trusting those institutions, until the dark times came. Banks have gained people’s trust, and that was just a beginning of incoming demise. Until 08/15/1971 we had a „gold standard” – it means that for every 35 U.S Dollars, you could go to any bank in America and exchange for one ounce of gold, and about 1,5 U.S. Dollar for one ounce of Silver. That was called, that Dollar was backed by gold, what gave Dollar a huge hegemony over every other currency around the world. This situation had one crucial advantage – Central Banks could not print more money, until more gold has been extracted. Today you’re being said, that only QE – Quantitative Easing (it’s just printing money) is stimulating the Economy, which is good because of one thing – it drives the consumption – but noone speaks about rising prices of almost everything.

Let’s have a closer look at picture above – a hit example – tomato’s soup price since beginning of 20th century. For almost 70 years, price of tomato soup was almost constant, with small fluctuations – it was caused exactly by restricted monetary system which caused anti-inflationary trend. What happened after 70 years of constant prices? In August 15th 1971 President of United States of America – Richard Nixon, has cut off gold standard – it was due to one thing – countries around the globe have been trading with dollars, and while some countries E.g. France have stored enough dollars in their vaults, they demanded gold in exchange of 35 U.S. Dollars. In this way United States have get rid of their gold’s reserves, and in the end it could led to one thing, which is insufficient financial liquidity. Ok, but why is that financial so important? Imagine, you are an entrepreneur, you have a company and you’re employing people. What would happen, if somehow your partners stopped paying for your goods/services? For few days maybe weeks, you would have to pay your liabilities from your savings/reserves, or even from credit loaned from bank. Here comes the question – for how long? Exactly. You can’t just like that pay your liabilities from debt, because eventually you’ll have to pay them. So in this situation, entrepreneur will instantly bankrupt. The same way was with United States when countries around the globe started the dollar exchange for gold in U.S’s vaults. United States could not afford bankruptcy, which could led to their economic demise.

So it begun...

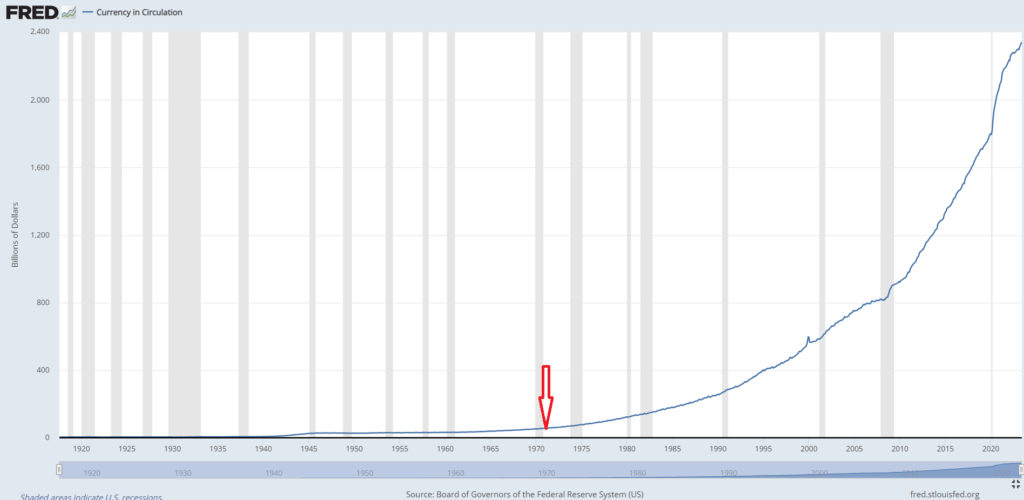

Until 1971 Central Bank of America – Federal Reserve (FED) had tied arms, and could not create more money, until they were backed by extracted gold. After this historical record, FED could create money to stimulate economy, and in the end it lead to one thing, which we all struggle with today – inflation. In this article, I will not discuss inflation and how exactly is created, but I want you to have a look at graph below, and try to connect the dots:

How is that? At the graph above, I’ve marked with red arrow beginning of gold’s cut off. Since then, the amount of money is constantly increasing! At the beginning we defined what money should look like. Let’s have a comparison now.

- Do banknotes have limited supply? No. They can be produced anytime, by central banks. Does gold have limited supply?

- Are banknotes durable? Not really. Despite the fact that they are made of special material, they are easily burned, they can be torned to pieces – certainly the dust is not worth anything. How looks gold comparing to banknote? Is gold susceptible to be burned, or torned? Of course it is, but comparing to banknotes, the value remains the same. Gold can be melted, but still 1 oz of liquid gold is equal to 1 oz of gold. It still has value itself.

- Are banknotes store of value? Definitely not – as you may know, 1 dollar from 1900 is not equal to dollar from 2000. You cannot buy the same amount of commodities as 100 years ago. An example? Be my guest – Ford’s cars were equal to 900 – 1260 U.S. Dollars 100 years ago. Then it was worth about 13 – 36 ounces of gold. How much is for the Ford’s car right now? Would you buy for 900 – 1260 U.S. Dollars a car? I don’t think so. Maybe couple of rims. And what is the worth of 13 – 36 ounces of gold today? It’s between 25,480 Dollars to 70,560 ( the article is written 26.07.2023, when the gold’s price is 1960 U.S. Dollars per ounce). Would you buy a car for that amount of money? Absolutely.

Blind faith

What if I told you, that I have three golden elephants, seven mountains and skyrocket in my house? Sounds ridiculous or irrational, but it is true – TRUST me. I do have these things for real! Would you believe me? Of course not! So why people so deeply believe Central Banks that all their deeds are for our prosperity?

„It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

Remember picture above? Have you noticed anything unusual? If not, now is the chance. There is a letter „L” missing „IN GO(L)D WE TRUST” statement – year 1971 has deleted „faith” in gold, and has begun faith in another thing/creature. It has begun FIAT money – „money” which relies on faith in something that might, or might not exist – Central Banks have started to create money out of nothing! Yes, you heard me right – they produce „money” just like that! And we all chase this rabbit, until these days. We’re not being taught in school about economics, so we follow paper money banknotes, which are being at this moment displaced by electronic money, and very soon by digital money, which is going to be fully based on faith in good behaviour.

Summary

Old Chinese adage says: „May you live in interesting times”. We are on brink of new financial system, and very few people know how it will look like. „Money” on your bank account can be taken away from you, if you say something wrong about government, or go to the protest on which you should not be – just a „Click” and you are deprived from resources to live. This is why you should think about this article, and draw some conclusions about real money which is known for thousand years, and the only owner of it, is you – not a bank in which you have a deposit and you can have claims to your own resources.